-

- Contact Us

- Privacy Policy

- term and condition

- Cookies policy

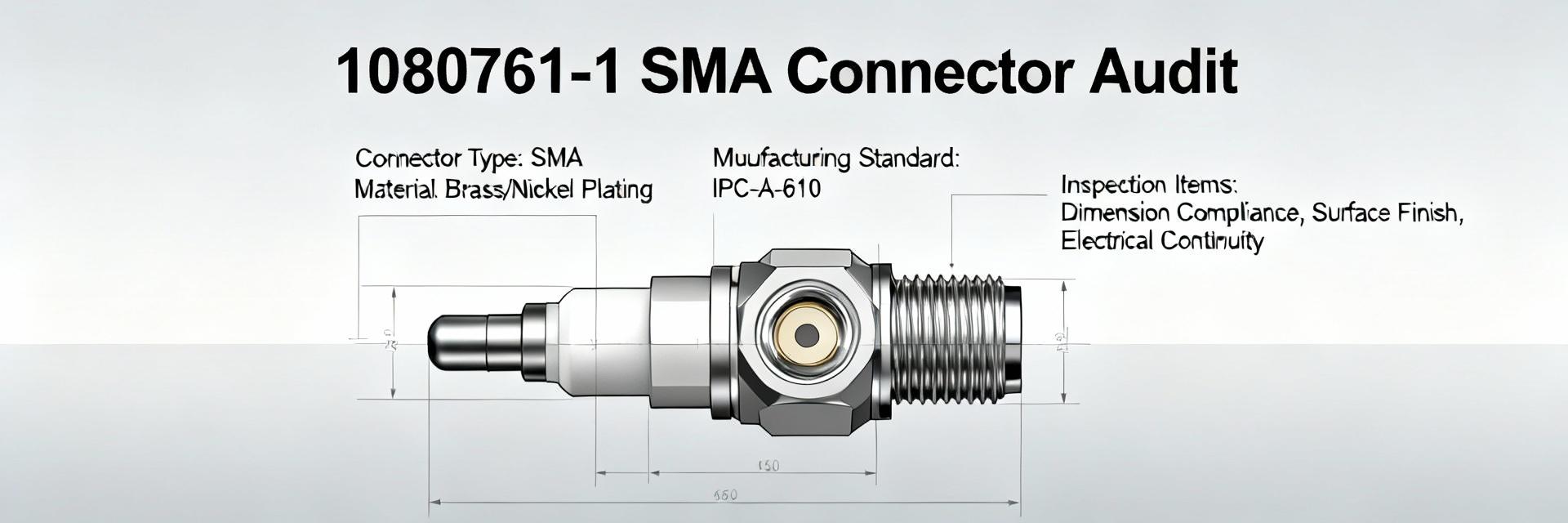

1080761-1 RF Coax Connector: Datasheet & Supplier Audit

According to distributor inventory snapshots and BOM audits, mismatch or counterfeit RF connectors account for up to 12–18% of RF interconnect failures in production runs—making correct specification and supplier validation for parts like the 1080761-1 critical. This article summarizes the 1080761-1 RF Coax Connector datasheet essentials and provides a practical supplier-audit and sourcing playbook to reduce risk in procurement and production.

The reader can expect a concise technical breakdown of part identification, a datasheet deep-dive of electrical/mechanical/environmental metrics, a supplier and traceability playbook, incoming inspection and test procedures, procurement and cost-driver guidance, and copy-ready clauses and checklists for supplier audit and lot acceptance. Target length: a detailed, scannable technical guide suitable for engineering, procurement, and QA teams.

1 — Background: 1080761-1 RF Coax Connector — Part ID & Key Specs

1.1 Part identification & nomenclature

Point: Correctly mapping "1080761-1" to its manufacturer and series is the first defense against mis-shipments and counterfeit parts. Evidence: Distributor BOM snapshots and part family tables typically show 1080761-1 as a specific series/variant within a manufacturer's RF plug catalog; suffixes often indicate plating, gender, or cable termination style. Explanation: When parsing the number, treat the base numeric string as the family identifier and any trailing or leading suffixes/prefixes as modifiers—examples include a suffix for gold plating thickness or a prefix for a custom launch style. Cross-references in internal part masters often add vendor prefixes (e.g., VND-1080761-1) or drop leading zeros; procurement should validate against the manufacturer's published part nomenclature and the manufacturer's PDF datasheet to confirm exact variant and finish.

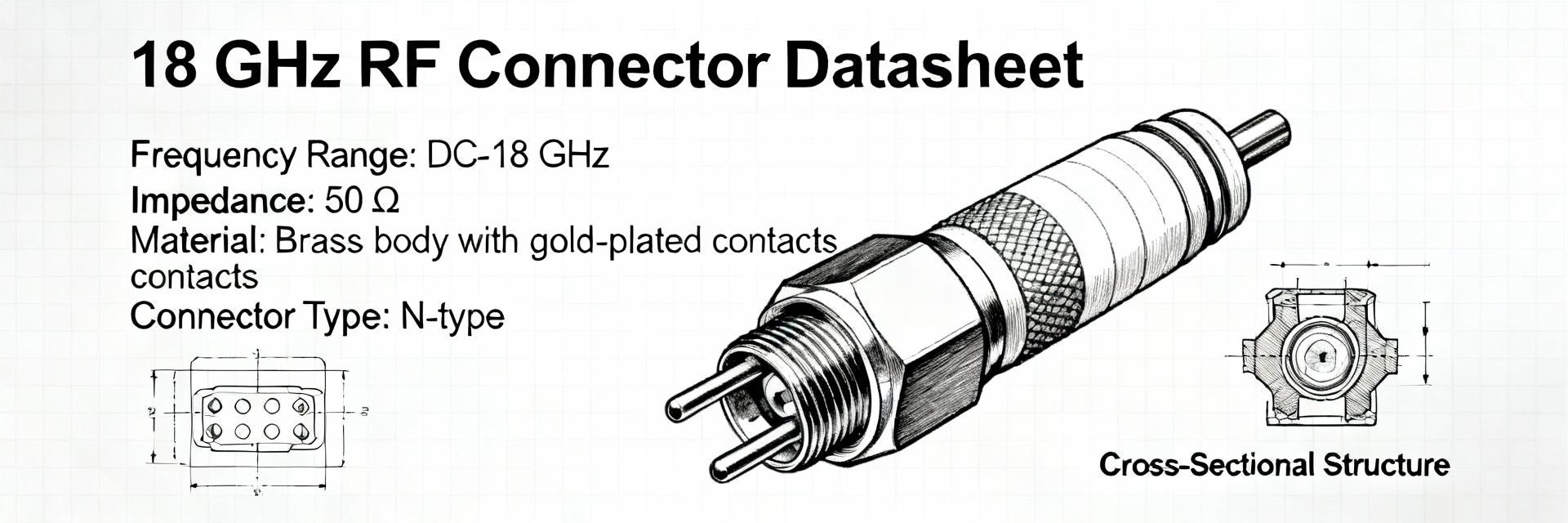

1.2 Physical & electrical summary (quick spec table)

Point: Extract headline specs from the datasheet to confirm fit-for-use before purchasing. Evidence: Typical datasheet items include connector style, impedance, frequency range, mating type, contact plating, body material, and basic dimensions. Explanation: The quick-reference table below consolidates those headline metrics so teams can validate compatibility at a glance; where a datasheet omits a value, the procurement clause should require supplier confirmation.

| Attribute | Typical Value / Notes |

|---|---|

| Connector type | SMA-style coax plug (verify manufacturer family) |

| Impedance | 50 Ω |

| Frequency range | DC to typical upper limit 18 GHz (confirm specific variant) |

| Mating style | Threaded SMA mating (male/female variant—verify) |

| Contact plating | Gold over nickel (thickness per datasheet; request µin/µm) |

| Body material | Stainless steel or brass (passivated or plated) |

| Dimensions | Datasheet dimension table; critical for panel/PCB footprint |

1.3 Typical cable/interface compatibility

Point: Matching cable types and mating interfaces prevents impedance discontinuities and mechanical mismatch. Evidence: Datasheet compatibility lists commonly cite RG-405, RG-400, and semi-rigid variants; mating interfaces are SMA or equivalent threaded receptacles. Explanation: Use the datasheet's recommended cable list as the primary guide—if the design uses an alternate cable, validate VSWR and insertion loss across the intended frequency band. Also note adapter compatibility: common adapters to N-type or BNC exist but introduce additional insertion loss and possible VSWR degradation; specify adapter use and required performance in procurement documentation.

2 — Datasheet Deep-Dive: Electrical, Mechanical & Environmental Data

2.1 Electrical performance metrics to extract

Point: Extract VSWR/Return Loss, insertion loss, power rating, frequency limits and impedance tolerance for proper RF performance validation. Evidence: Datasheets typically include VSWR vs frequency curves, insertion loss at defined cable lengths and test fixtures, and absolute impedance (50 Ω). Explanation: For procurement and acceptance, record the test conditions alongside numeric values—e.g., VSWR

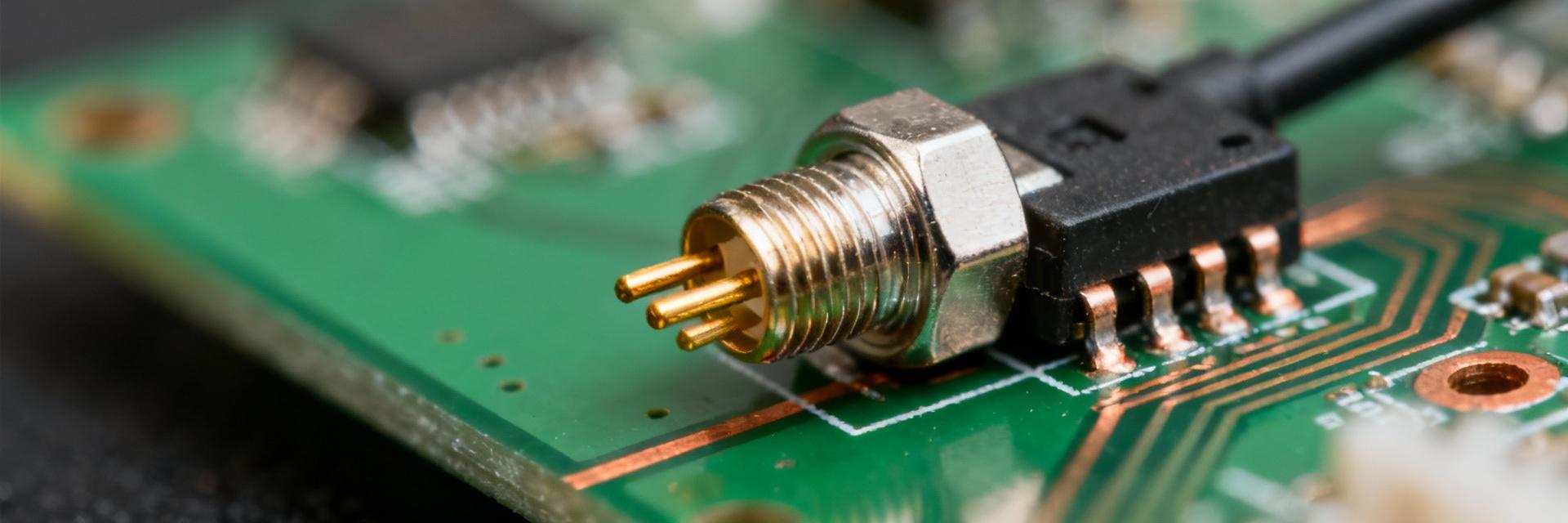

2.2 Mechanical & materials data points

Point: Mechanical specs—mating cycles, torque, contact retention, plating thickness and tolerances—drive assembly reliability and fit. Evidence: Manufacturer documentation typically specifies mating durability (e.g., 500 cycles), recommended torque for threaded mating, plating microinches/µm, and dimensional tolerances for critical mating features. Explanation: Capture and tabulate torque ranges (Nm or in-lb), acceptable deviation for critical diameters, and minimum plating thickness (e.g., 0.5 µm Au). These values inform incoming dimensional inspection and torque tool calibration for assembly. Flag items where tolerances affect PCB footprint or panel hole sizes—procurement should require supplier confirmation for any non-standard tolerance bands.

2.3 Environmental, reliability & lifecycle specs

Point: Environmental ratings determine suitability for intended applications and lifecycle expectations. Evidence: Datasheets commonly list operating temperature range, thermal shock, vibration, humidity, and salt spray resistance; some include MTBF or lifecycle guidance for specified environments. Explanation: Note min/max operating temperatures (e.g., -55 °C to +125 °C), vibration profiles (e.g., random vibration g levels and hours), and corrosion resistance (salt spray hours). For mission-critical uses, convert these to acceptance tests—thermal cycling and salt spray samples—before lot release. If MTBF or lifecycle metrics are not explicit, require supplier-provided reliability test data aligned to intended use.

3 — Supplier Landscape & Traceability: Who Makes & Stocks 1080761-1

3.1 Authorized manufacturers vs aftermarket sources

Point: Differentiate OEM brand owners from aftermarket suppliers to reduce counterfeit risk. Evidence: Manufacturer families often have clear lineage and published part families; aftermarket vendors may rebrand or relabel. Explanation: Build a watchlist of known OEM brands and their family designations; when a quoted vendor is unfamiliar, require documentation tying the vendor to an authorized supply chain or insist on manufacturer-stamped packaging and lot traceability. Maintain a preferred vendor list limited to authorized distributors and manufacturer-authorized channel partners.

3.2 Distributor verification & purchase channels

Point: Use authorized distributors for traceability and COA availability; verify lot codes and datasheet alignment. Evidence: Distributor SKUs should match manufacturer datasheet spec tables and include datasheet revision numbers in product listings. Explanation: The vendor-checklist for distributor purchases should include: datasheet revision match, availability of Certificate of Conformance (COC/COA), visible lot/batch codes, supplier authorization statements, and packaging photos. For high-risk buys, require manufacturer-signed COA and lot traceability down to raw material lots where available.

3.3 Counterfeit risk & provenance checks

Point: Proactive provenance checks reduce counterfeit acceptance. Evidence: Common red flags include prices materially below market, missing or inconsistent markings, non-standard packaging, and absence of lot traceability. Explanation: Implement physical checks (marking legibility, consistent font and laser etch patterns), package inspections (sealed bag, desiccant, factory label), and verification methods (lot/batch cross-check with manufacturer). For high-risk or legacy parts, consider non-destructive XRF plating checks to confirm surface plating composition and basic thickness ranges before lot release.

4 — Inspection & Test Procedures for Incoming & Production Units

4.1 Incoming QC checklist (visual & dimensional)

Point: A standardized incoming inspection reduces escape of non-conforming parts. Evidence: Datasheet tolerances and visual examples establish acceptance criteria. Explanation: Use the checklist below to accept or reject shipments; document failures and quarantine suspect lots. Acceptance criteria should specify allowable marking legibility, dimensional tolerances per datasheet table, and plating uniformity standards.

- Visual: marking present & correct; no burrs, scratches, or contamination.

- Dimensional: critical dimensions measured within datasheet tolerances (use calibrated calipers/micrometers).

- Plating: no flaking; color/finish consistent with manufacturer standard.

- Packaging: sealed bags, correct label, lot code present.

- Documentation: COA/COC included and matches lot number.

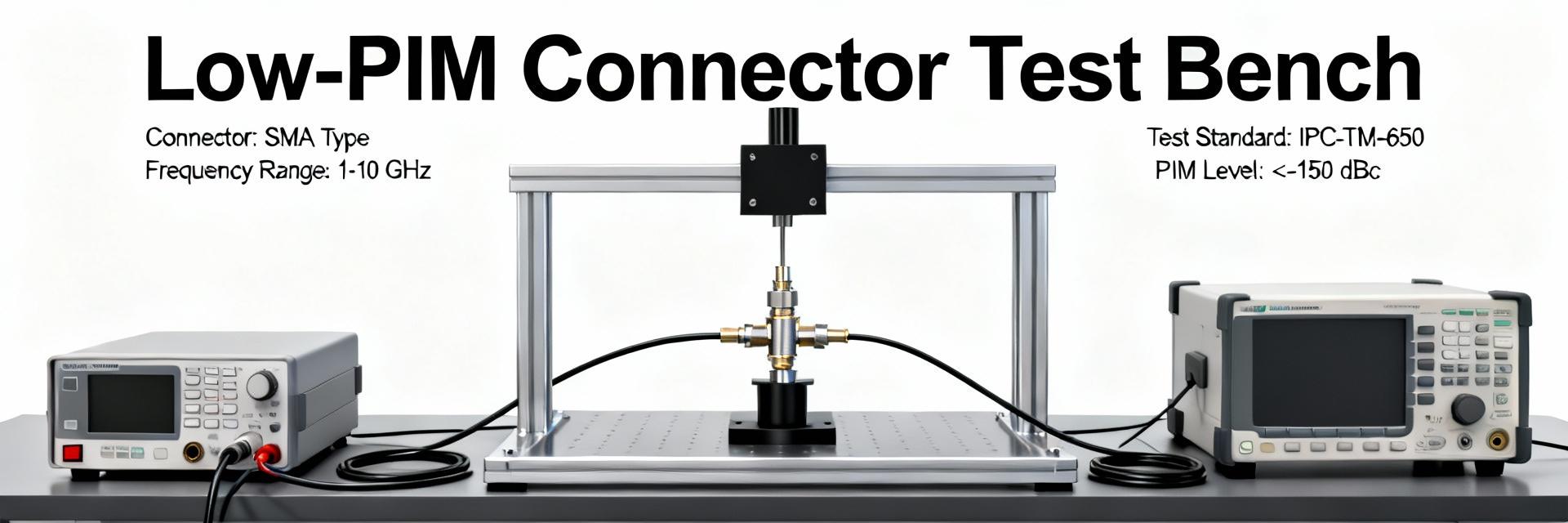

4.2 Electrical verification & sample testing

Point: Sample electrical testing confirms functional conformity to datasheet performance. Evidence: Datasheet VSWR curves and insertion loss values provide acceptance thresholds. Explanation: Recommended sample plan: for small lots (≤1000 pcs) test 5 units; for larger lots test 10 units or 1% (whichever larger), using calibrated VNA for S-parameter sweep across the intended band. Pass/fail thresholds: VSWR within datasheet max +10% margin or absolute limit (e.g., VSWR ≤1.5 if datasheet ≤1.3), DC continuity

4.3 Mechanical & environmental verification

Point: Validate mechanical durability and environmental resilience before full production use. Evidence: Datasheet mating cycles, torque, and environmental test specs define expected behavior. Explanation: Perform sample mating cycle tests (e.g., 100–500 cycles depending on datasheet), retention/withdrawal force checks, and thermal cycling on representative samples. For harsh-environment applications, run salt spray or humidity exposure per datasheet hours and inspect for corrosion or plating failure. Document all test reports and retain with lot records.

5 — Procurement, Cost Drivers & Alternatives

5.1 Pricing factors & lead-time considerations

Point: Material composition, plating spec, and finish drive cost and lead time. Evidence: Gold plating thickness, base metal selection (brass vs stainless), and custom finishes increase price and may cause MOQ constraints. Explanation: Negotiate on forecast and blanket orders to reduce unit cost and stabilize lead time; request lead-time escalation clauses and supplier capacity confirmation. Use volume forecasts to secure manufacturing slots and leverage alternative finishes where acceptable for cost savings.

5.2 Approved alternates & cross-reference strategy

Point: Qualified alternates mitigate single-source risk. Evidence: Alternates must match electrical specs, mechanical fit, and environmental ratings per datasheet. Explanation: Create a short checklist to validate alternates: identical impedance and frequency capability, equal or better VSWR/insertion loss, matching mating dimensions and torque, plating parity, and documented qualification testing. Maintain engineering approval records for each approved alternate.

5.3 Compliance, RoHS & contract requirements

Point: Regulatory and contract compliance must be documented before acceptance. Evidence: Suppliers commonly provide RoHS/REACH declarations and DFARS or other contract-specific attestations. Explanation: Require supplier-signed declarations of conformity, applicable test reports (e.g., RoHS screening), and for regulated programs request traceable material lot data. For defense or regulated procurements, request DFARS/ITAR compliance evidence as applicable.

6 — Practical Action Playbook: How to Specify, Audit & Approve 1080761-1

6.1 Specification template & procurement language

Point: Standardized procurement language reduces ambiguity in RFQ/PO. Evidence: Clear clauses referencing exact part number, datasheet revision, required tests and traceability reduce supplier interpretation risk. Explanation: Include copy-ready clauses such as: "Part: 1080761-1 per manufacturer's datasheet Rev X; supplier must provide COA with lot traceability; electrical acceptance: VSWR ≤ [value] across 0–X GHz measured on calibrated VNA; mechanical acceptance: mating cycles ≥ [value]; packaging: factory sealed, labeled with lot code; lot-specific sample testing report required prior to release."

6.2 Supplier-audit checklist (pre-qualification steps)

Point: Pre-qualification audits verify supplier capability and anti-counterfeit controls. Evidence: Audit items should include process controls, traceability, and certification evidence. Explanation: Concise audit checklist: ISO 9001/AS9100 certification, documented process flows for RF connector production, anti-counterfeit policies, sight of incoming material inspection records, sample test reports against datasheet, packaging controls, and willingness to allow on-site inspection or third-party test verification. Require corrective action plans for identified gaps before approval.

6.3 Lot acceptance & lifecycle management

Point: A controlled lot-acceptance flow ensures only qualified material enters production and that supply changes trigger requalification. Evidence: Standard flow: sample test → quarantine → release, with requalification triggers on supplier or process change. Explanation: Implement documented lot acceptance with quarantine staging; release only after passing specified sample tests and COA verification. Define requalification triggers: supplier change, manufacturing location change, failed lots, or observed field anomalies. Add obsolescence monitoring to identify lifecycle risks early and qualify alternates proactively.

Summary (10-15% of article)

- Extract critical electrical, mechanical and environmental specs from the 1080761-1 datasheet before purchase to ensure performance and fit.

- Validate suppliers through authorized distributor channels, require COAs and lot traceability, and watch for counterfeit red flags.

- Apply incoming QC and defined sample electrical/mechanical tests to each lot; use clear acceptance criteria and quarantine flows.

- Negotiate on forecasts and blanket orders to manage lead time and pricing; maintain an approved-alternate qualification process.

- Embed the provided procurement clauses and audit checklist into RFQs/POs to reduce mismatch and counterfeit risk for the 1080761-1 RF Coax Connector Datasheet-driven buys.

Frequently Asked Questions

1 — What are the most important datasheet values for 1080761-1?

The highest-priority datasheet values are impedance (50 Ω), VSWR/Return Loss across your operating band, maximum frequency rating, contact plating specification (type and minimum thickness), mating cycle durability, and dimensional tolerances for mating interfaces. Document the exact test conditions reported in the datasheet (test fixture, cable type, calibration references) so incoming tests mirror manufacturer conditions as closely as possible.

2 — How should procurement phrase RFQs to avoid receiving non-conforming 1080761-1 parts?

Include exact part number and datasheet revision, require COA with lot traceability, specify electrical acceptance criteria (e.g., VSWR limits and measurement conditions), list mechanical requirements (mating cycles, torque), demand factory-sealed packaging with lot labels, and require sample test reports prior to lot release. Add a clause that rejects substitutions without prior engineering approval.

3 — What quick checks detect counterfeit or mismatched 1080761-1 connectors on receipt?

Quick checks include verifying lot and part markings match the manufacturer format, inspecting packaging for factory seals and correct labeling, measuring a small set of critical dimensions against datasheet tolerances, performing a visual plating and finish inspection, and confirming COA lot numbers with supplier records. For suspicious lots, run an S-parameter sweep on a sample and consider non-destructive plating analysis (XRF) to confirm surface composition.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- APT50GH120B Datasheet Deep Dive: Specs, Ratings & Curves

- APT50GH120BSC20 Power Module: Latest Performance Report

- APT50GH120BD30 IGBT: How to Maximize Efficiency for EV Drive

- GTSM20N065: Latest 650V IGBT Test Report & Metrics

- CMSG120N013MDG Performance Report: Efficiency & Losses

- GTSM40N065D Technical Deep Dive: 650V IGBT + SiC SBD

- NOMC110-410UF SO-16: Live Stock & Price Report

- 1757255 MSTBA 5.08mm PCB: Step-by-Step Install & Solder

-

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606

EXB-V4V120JVPanasonic Electronic ComponentsRES ARRAY 2 RES 12 OHM 0606 -

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606

EXB-V4V473JVPanasonic Electronic ComponentsRES ARRAY 2 RES 47K OHM 0606 -

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606

EXB-V4V823JVPanasonic Electronic ComponentsRES ARRAY 2 RES 82K OHM 0606 -

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606

EXB-V4V151JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150 OHM 0606 -

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606

EXB-V4V181JVPanasonic Electronic ComponentsRES ARRAY 2 RES 180 OHM 0606 -

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606

EXB-V4V331JVPanasonic Electronic ComponentsRES ARRAY 2 RES 330 OHM 0606 -

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606

EXB-V4V152JVPanasonic Electronic ComponentsRES ARRAY 2 RES 1.5K OHM 0606 -

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606

EXB-V4V563JVPanasonic Electronic ComponentsRES ARRAY 2 RES 56K OHM 0606 -

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606

EXB-V4V104JVPanasonic Electronic ComponentsRES ARRAY 2 RES 100K OHM 0606 -

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606

EXB-V4V154JVPanasonic Electronic ComponentsRES ARRAY 2 RES 150K OHM 0606